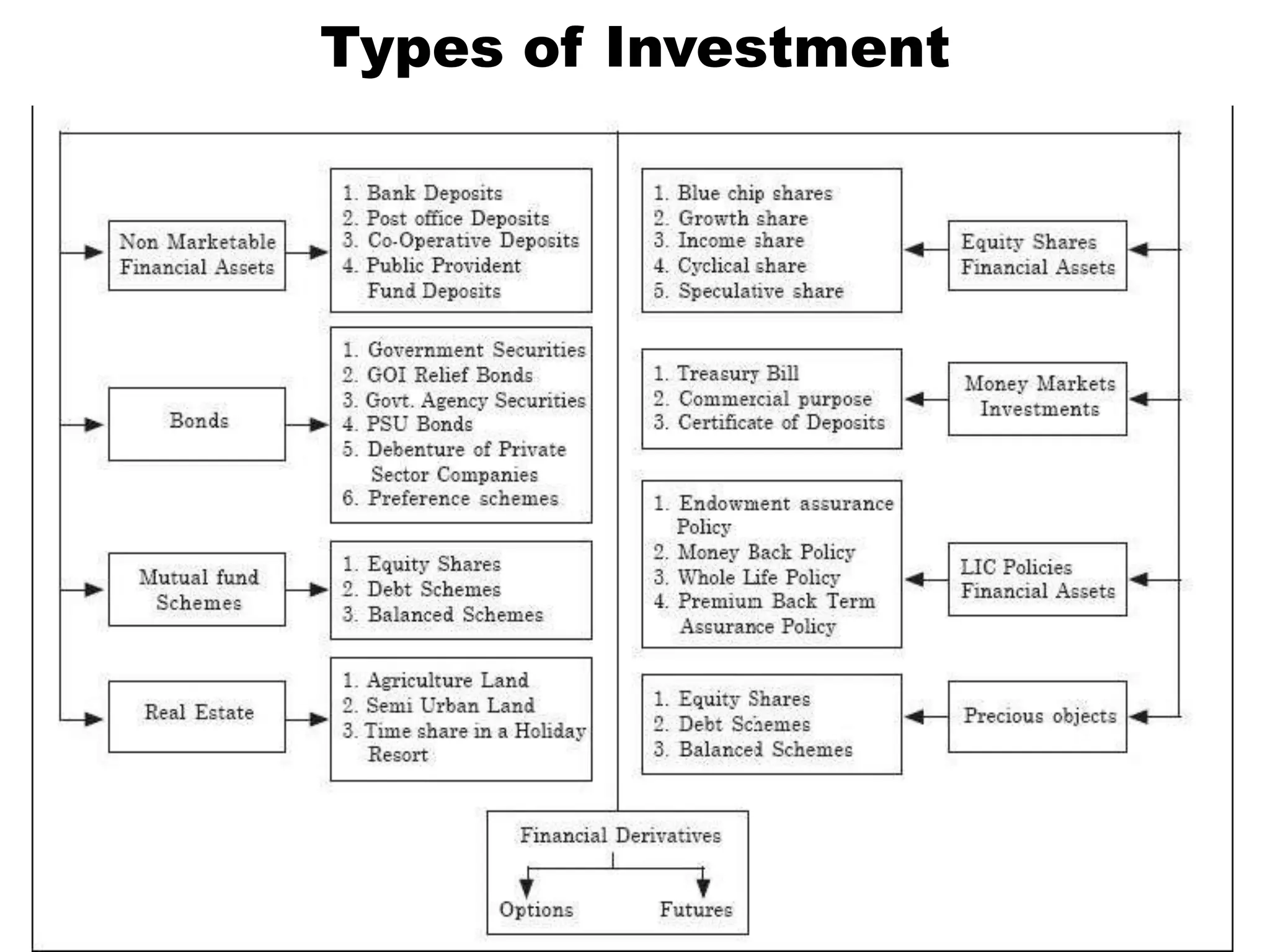

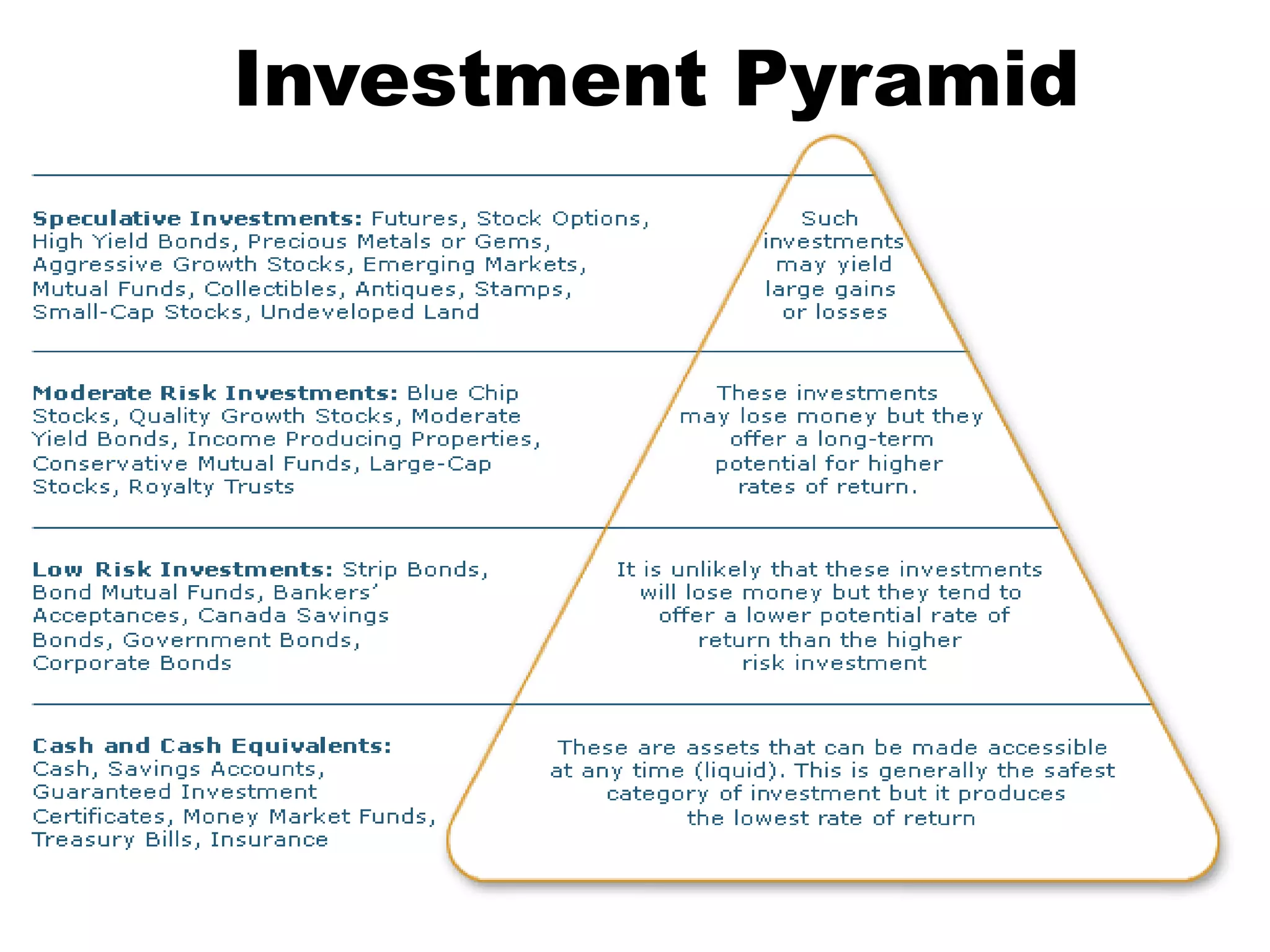

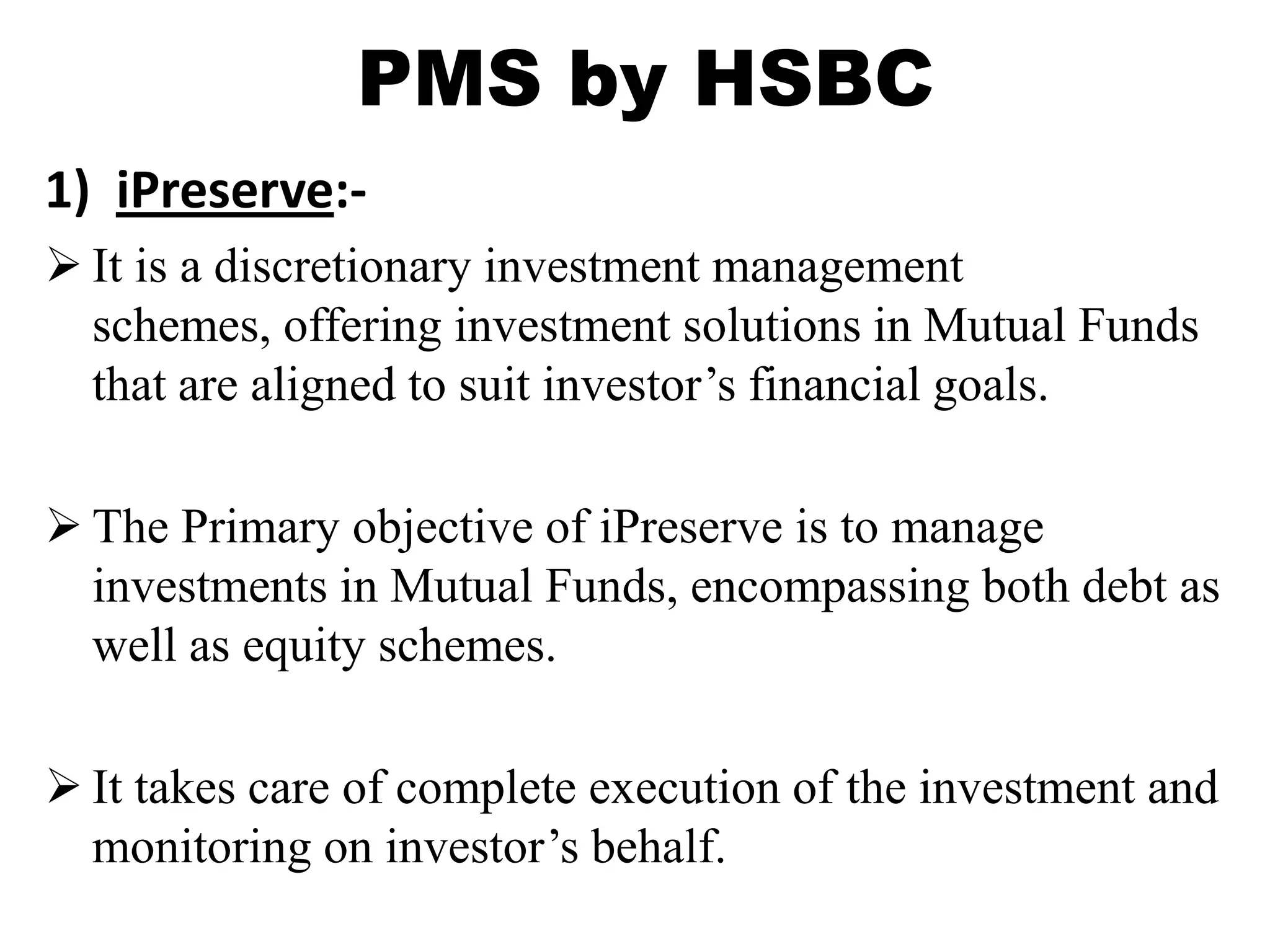

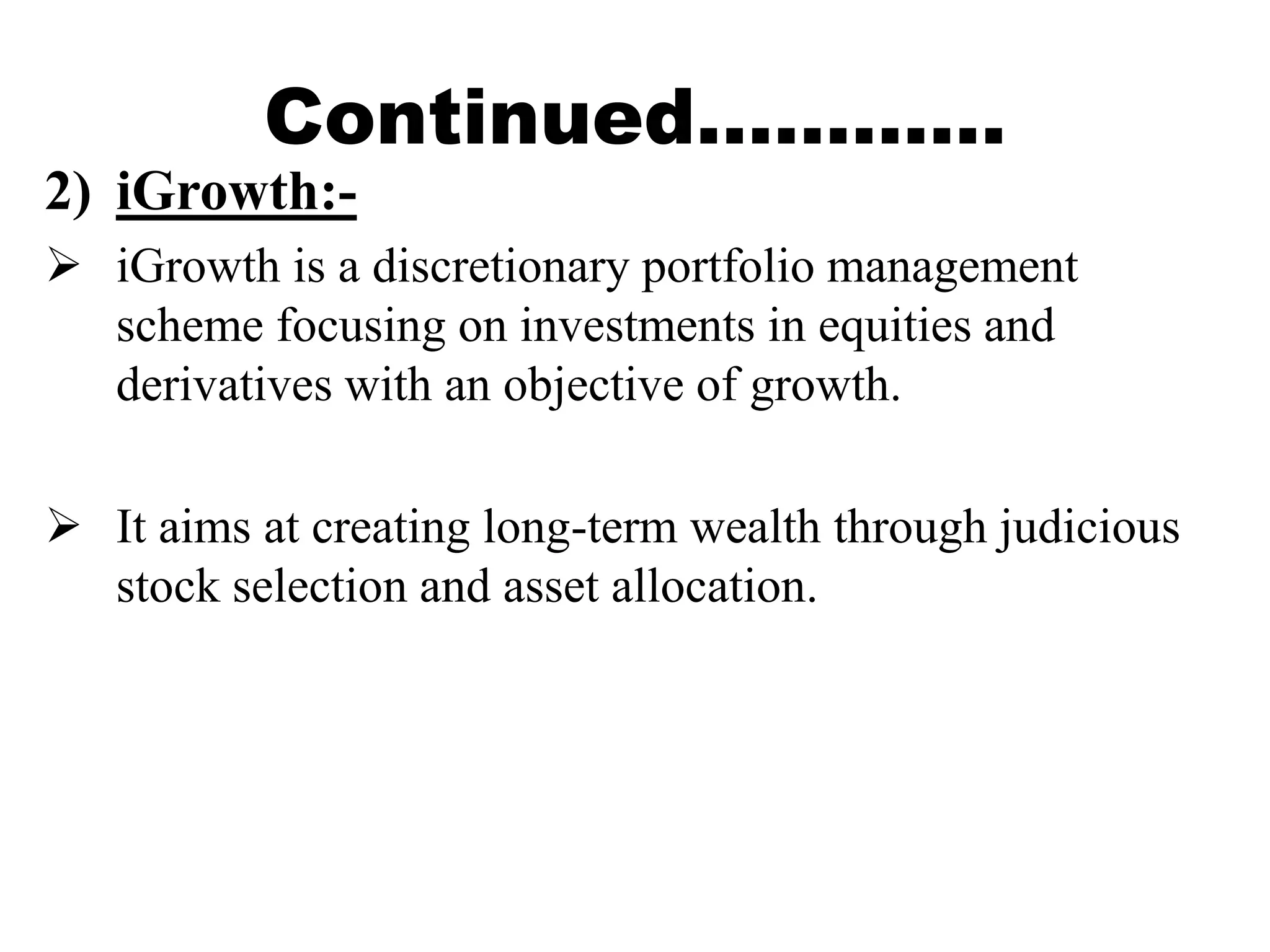

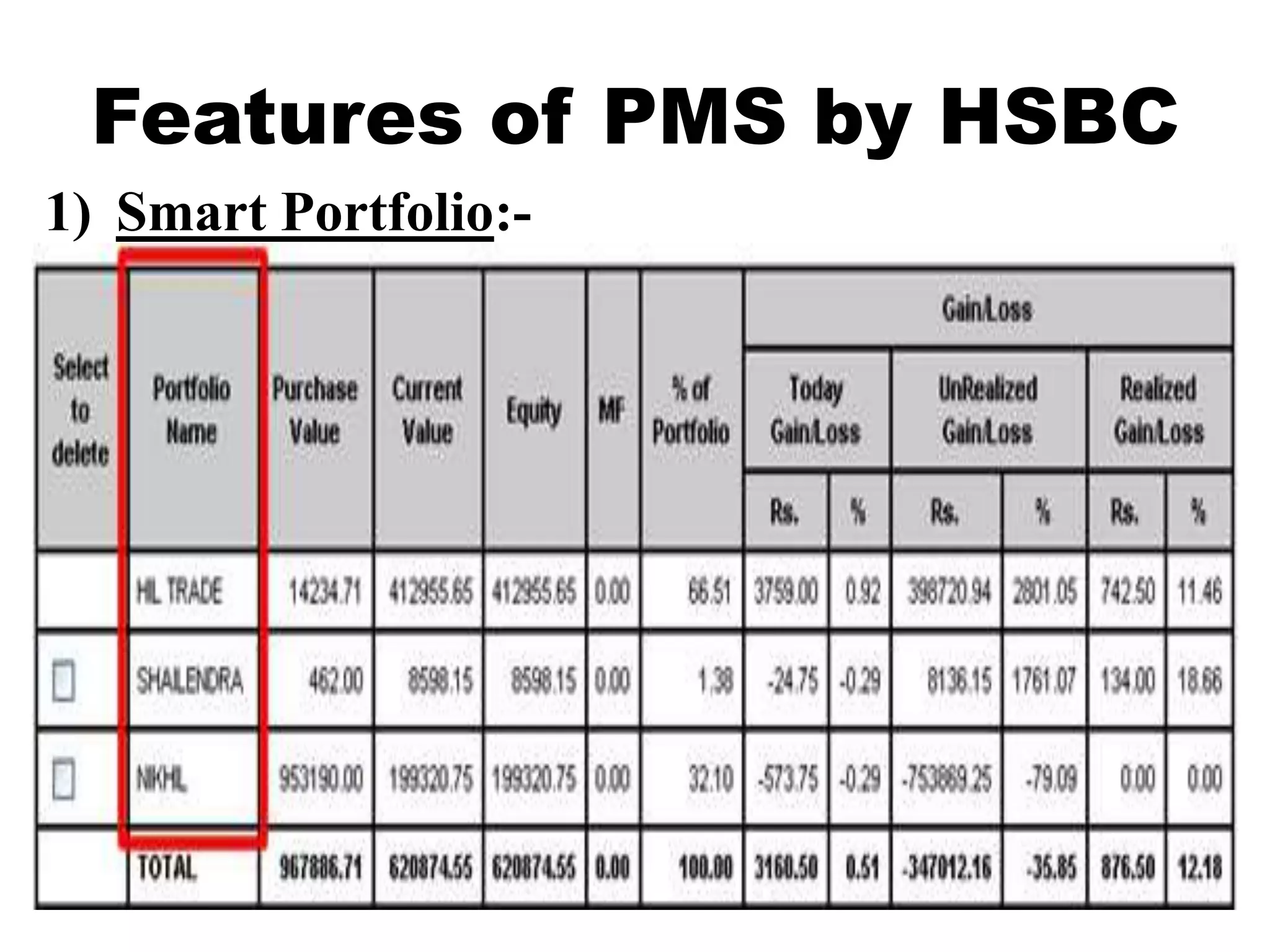

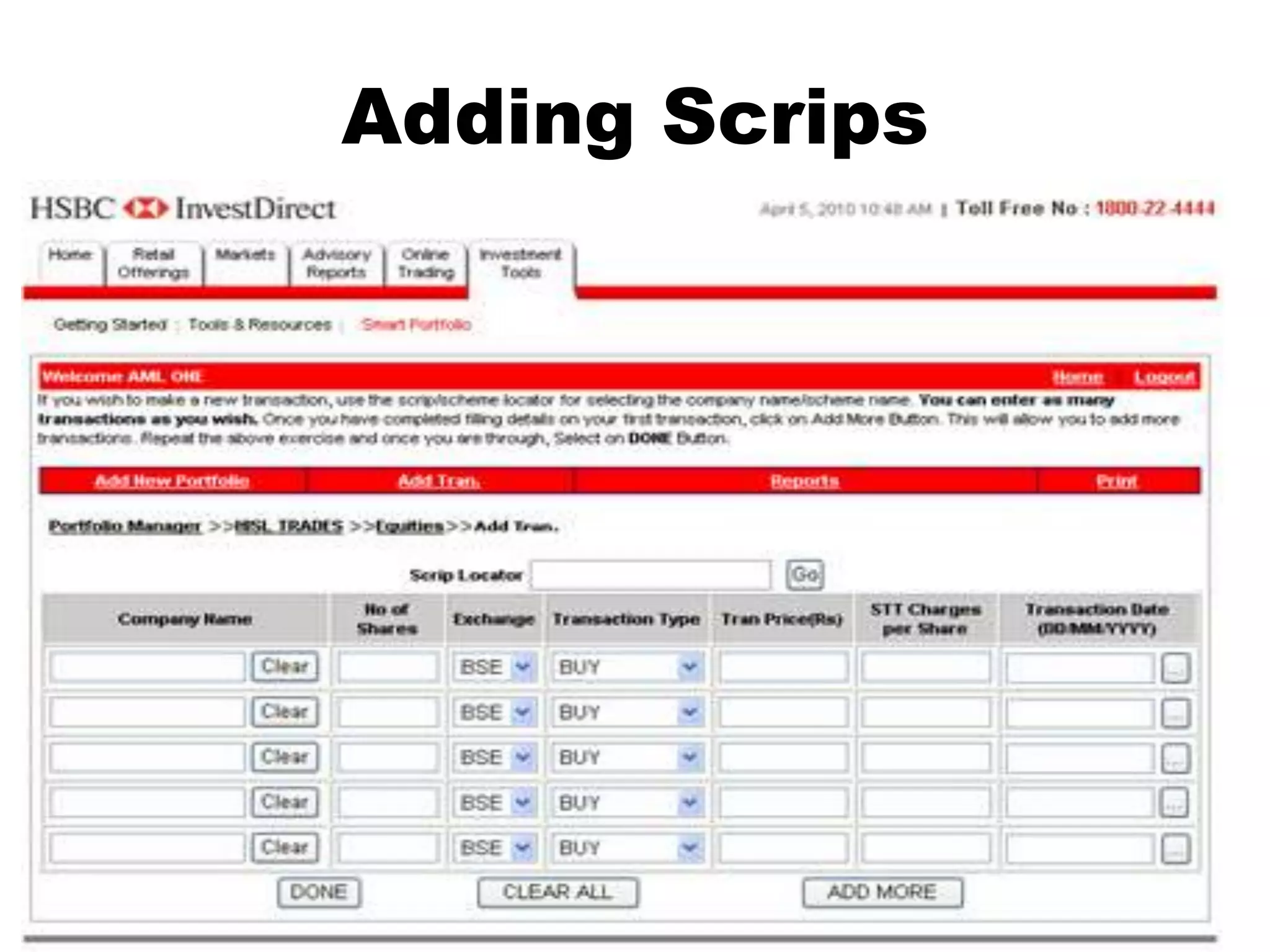

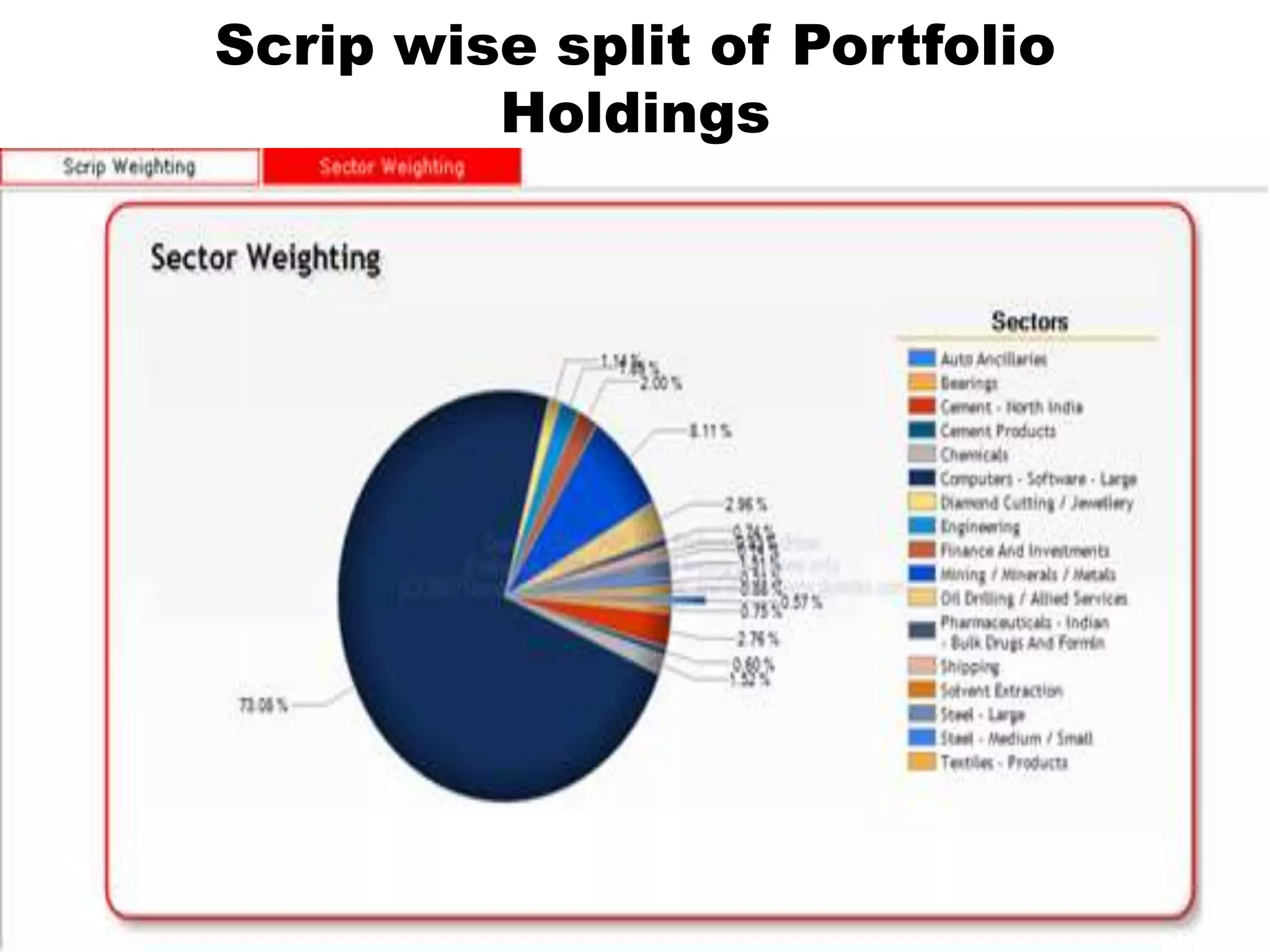

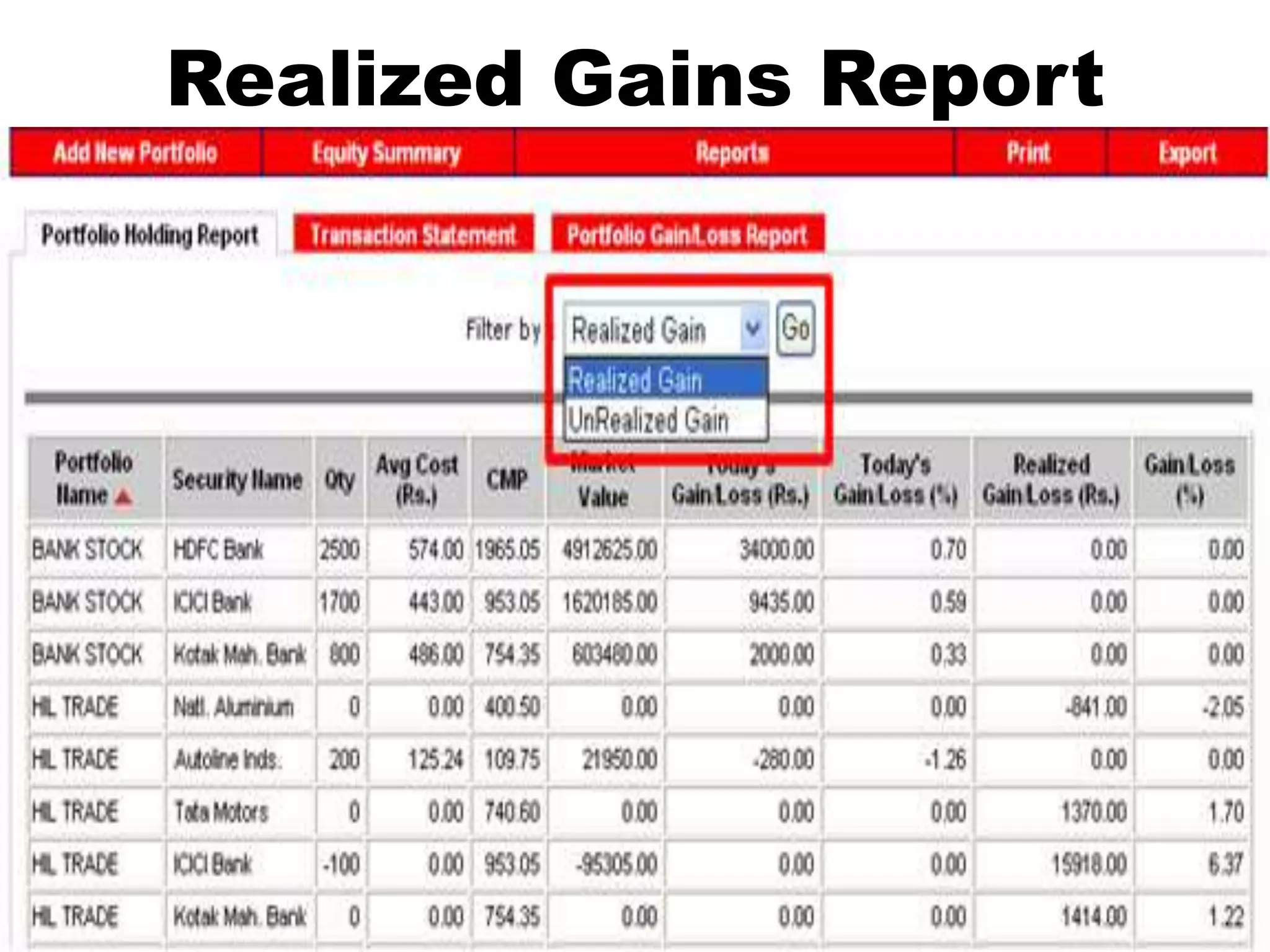

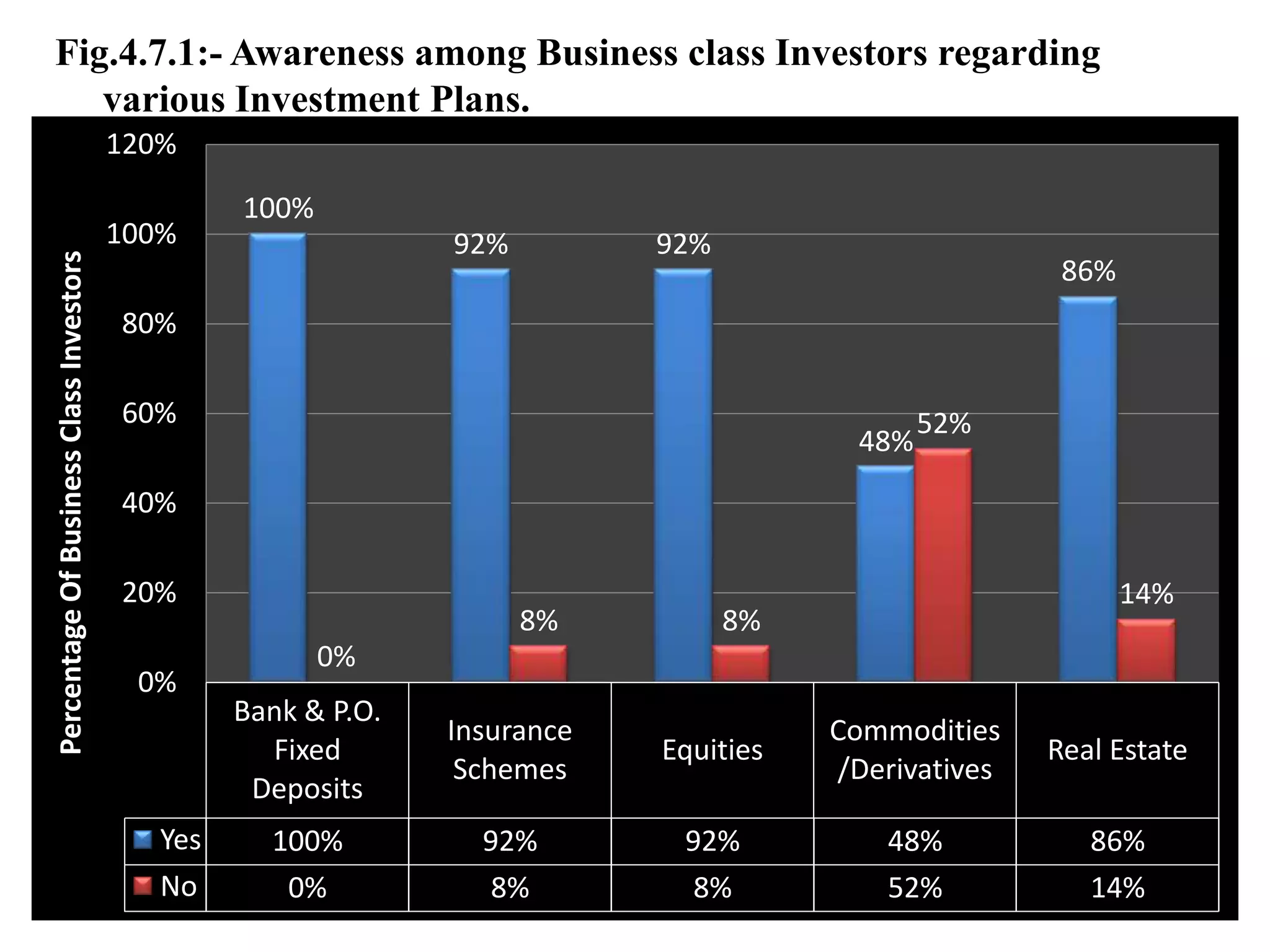

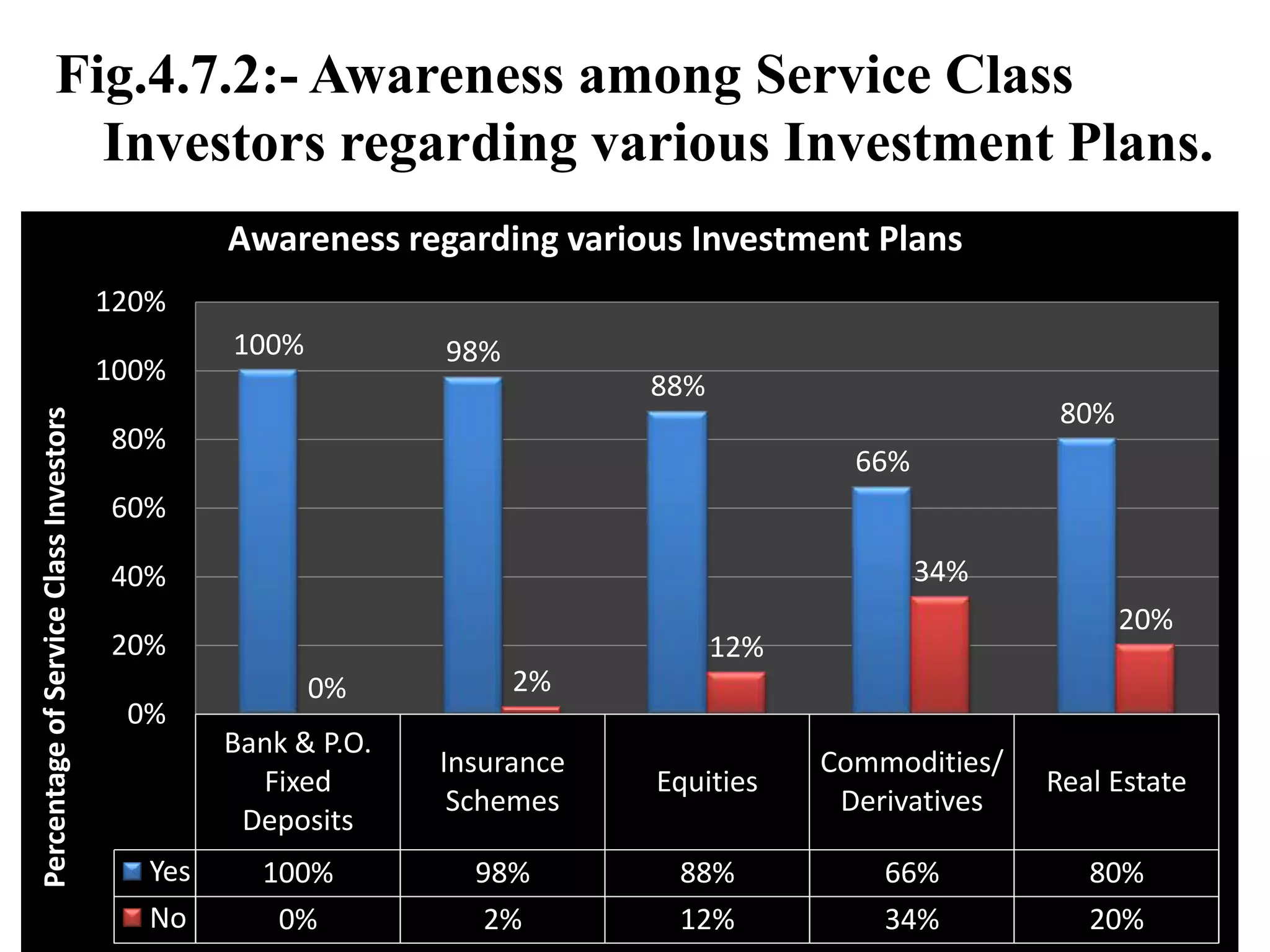

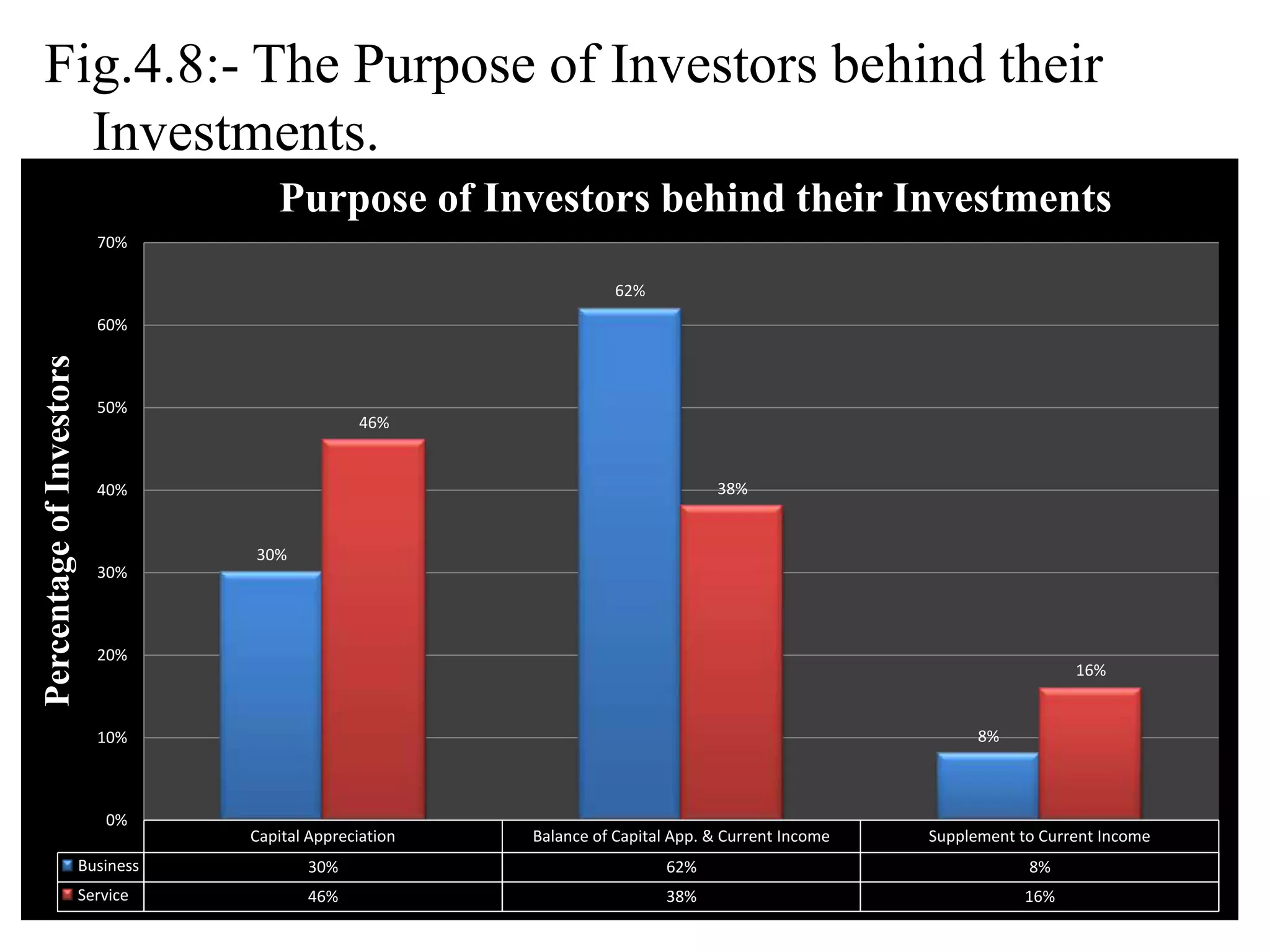

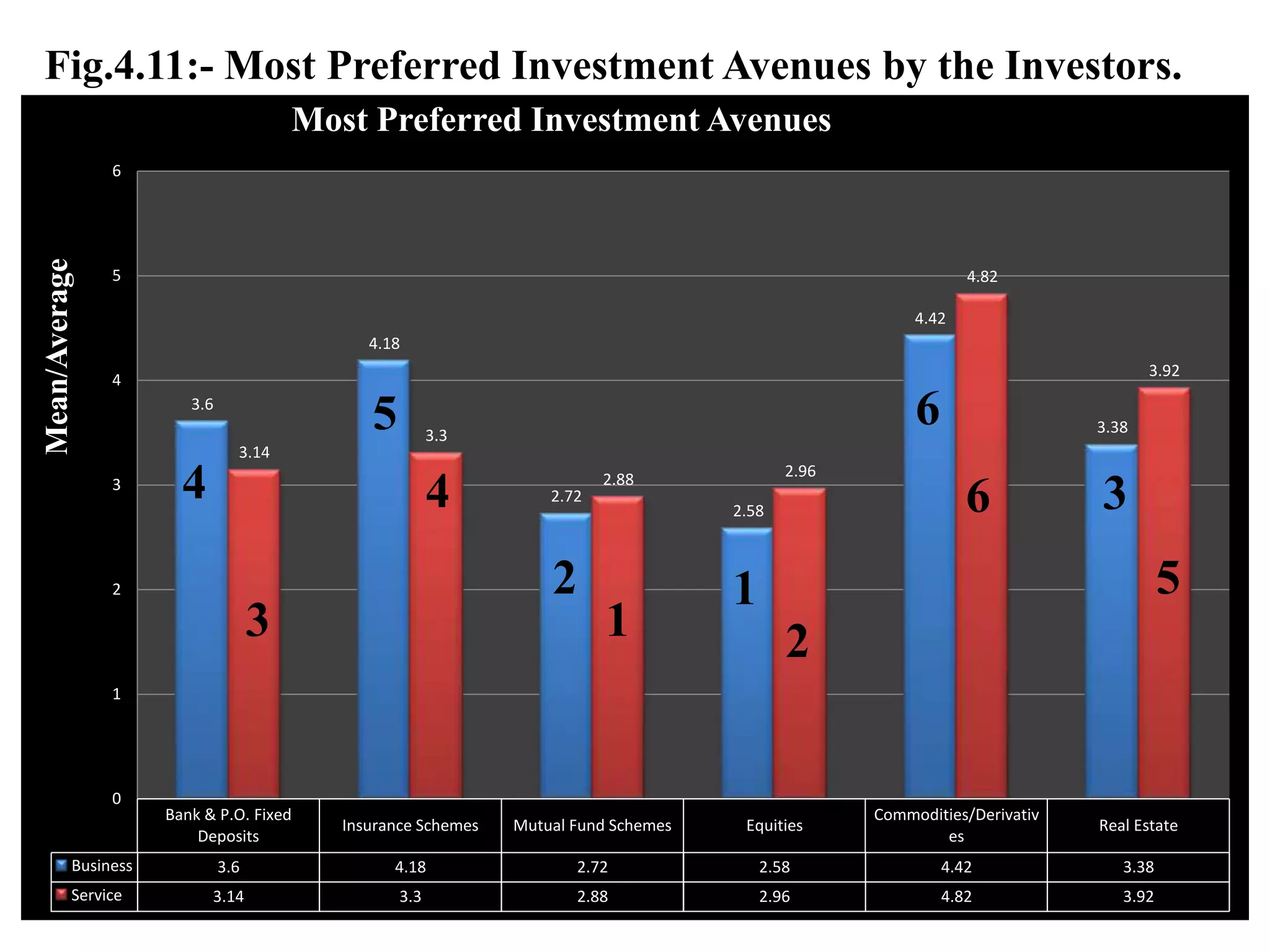

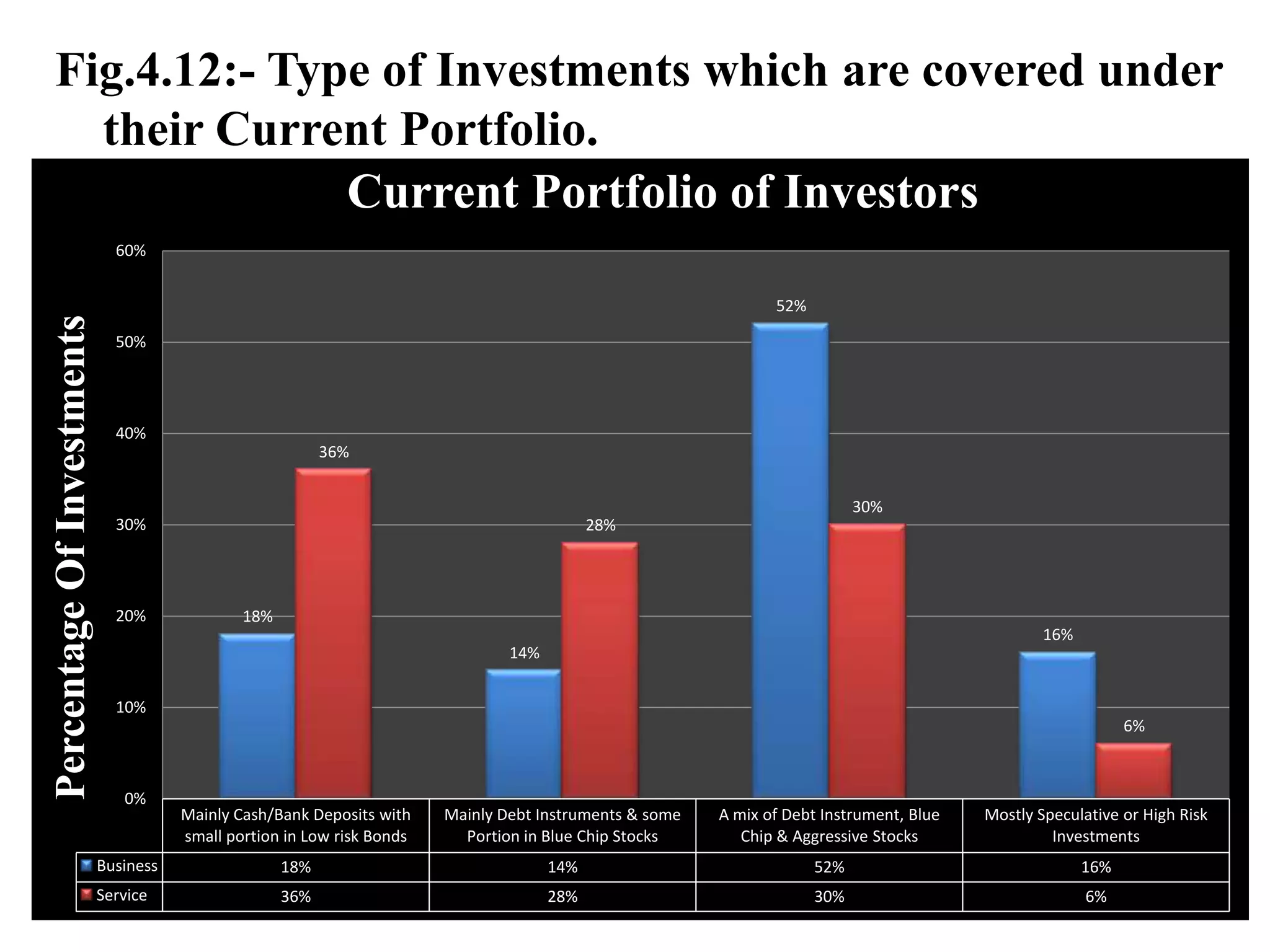

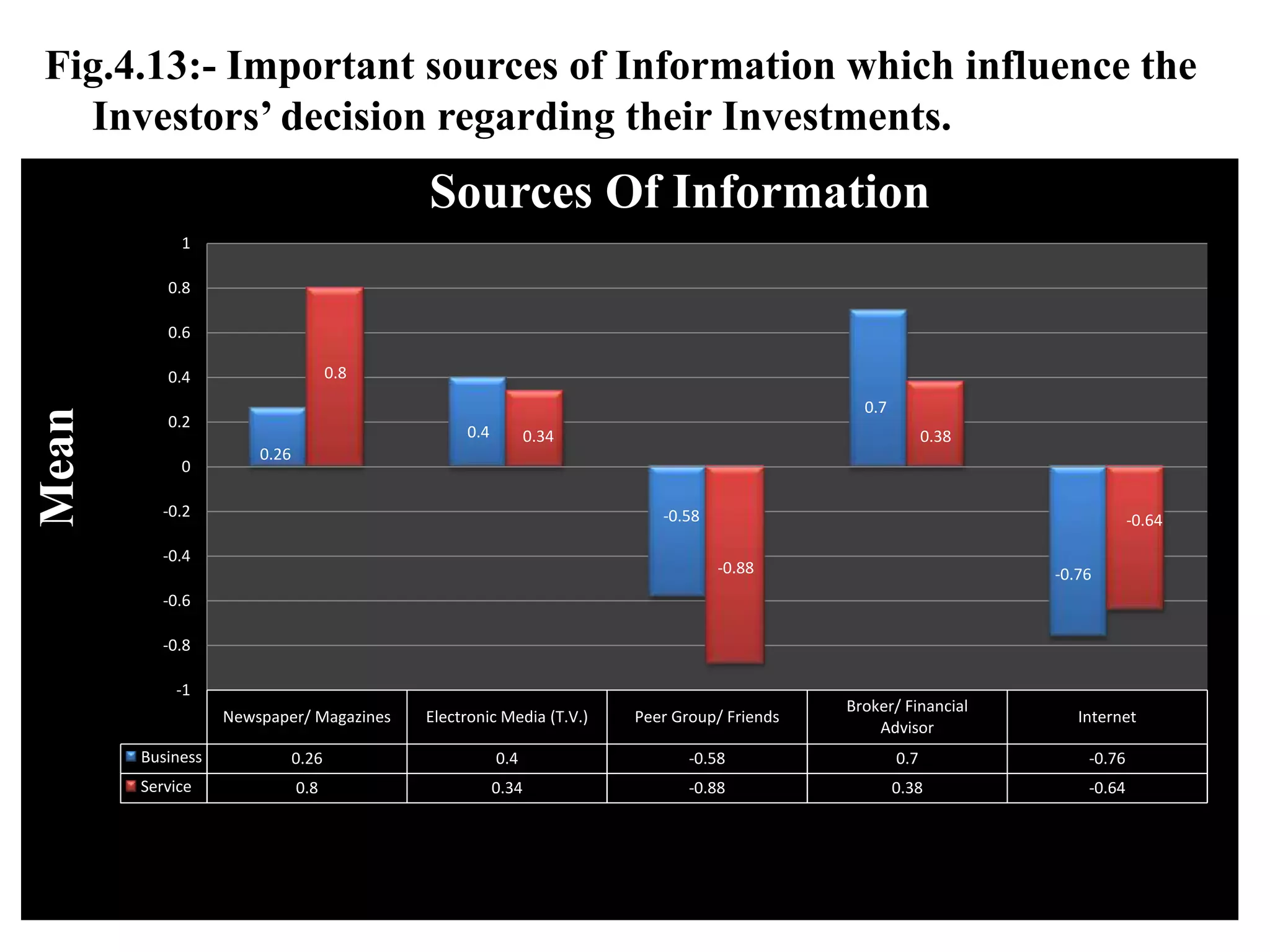

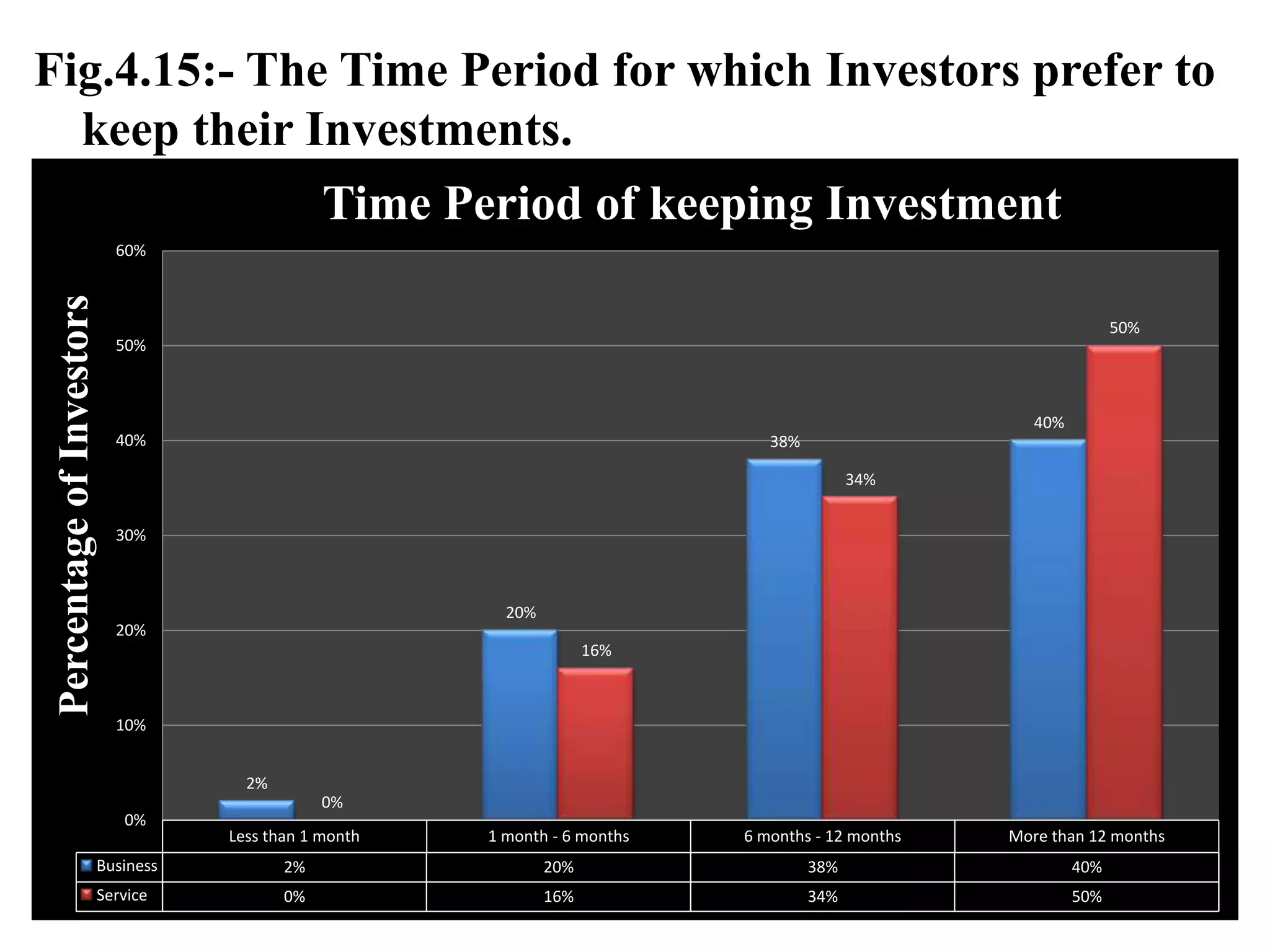

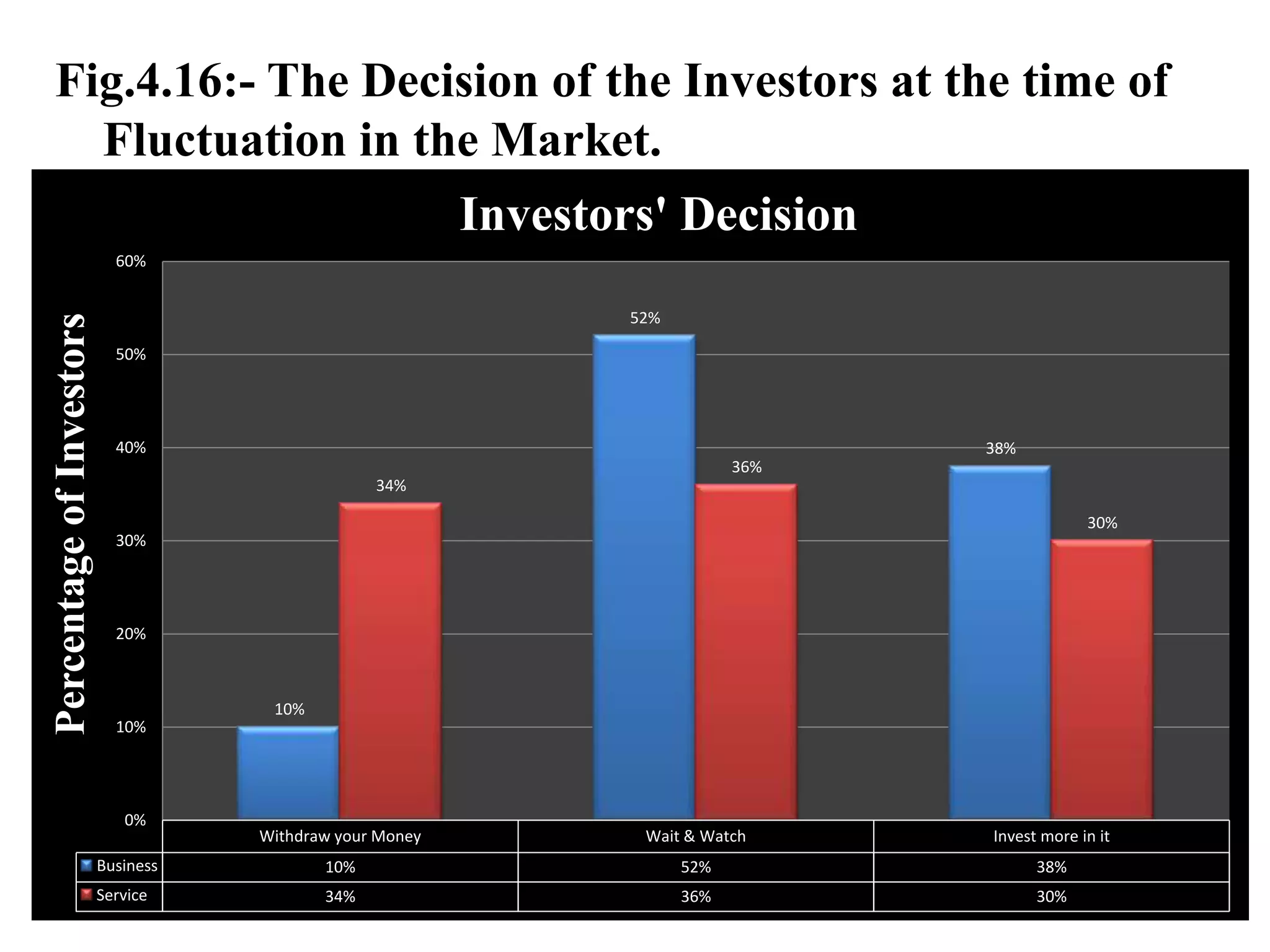

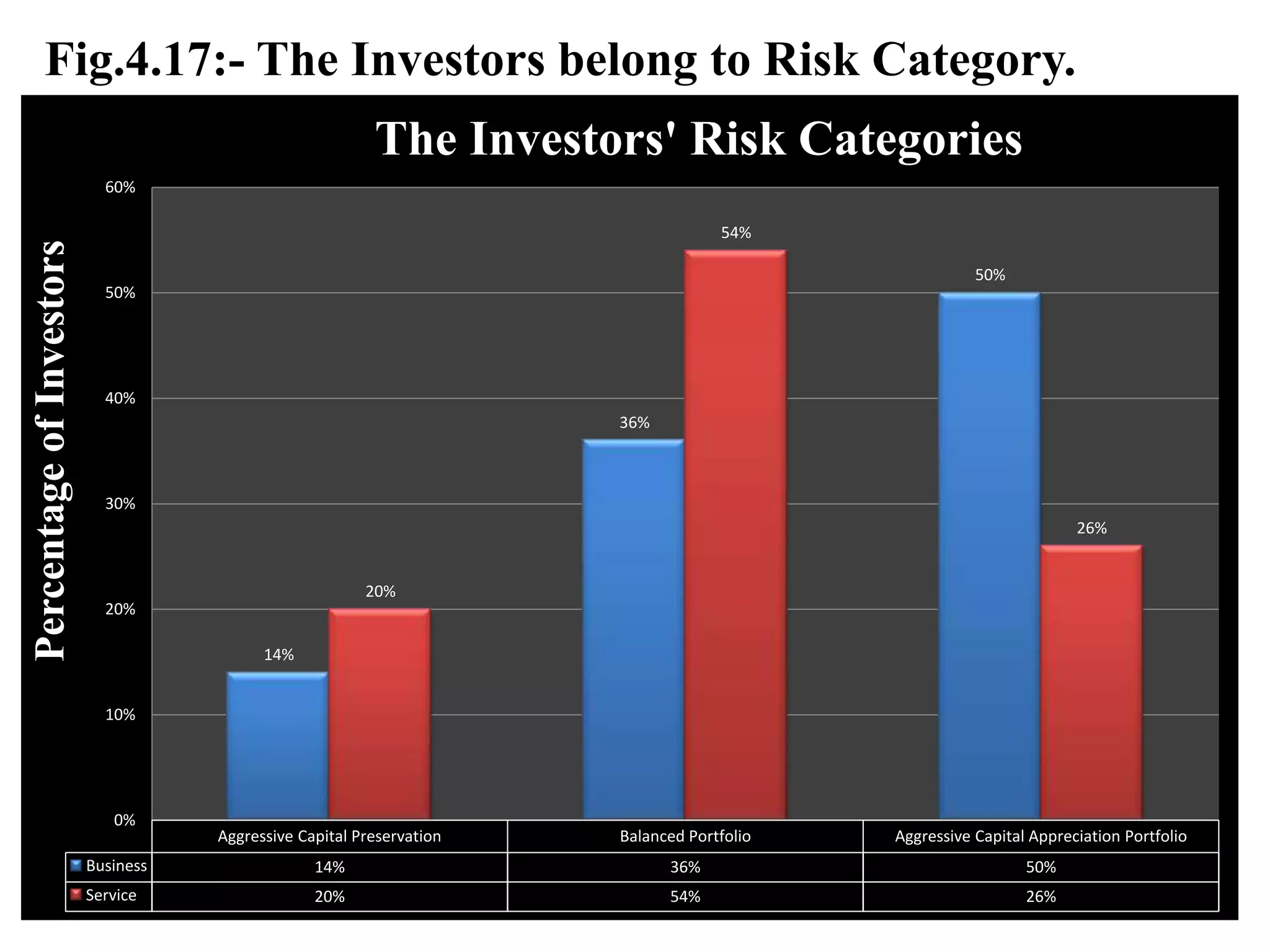

This document presents a comparative analysis of the investment portfolios of business class and service class investors of HSBC InvestDirect in Ludhiana. It finds that business class investors prefer higher risk investments like equity and real estate and have a longer investment horizon. They fall under an aggressive capital appreciation portfolio. Service class investors prefer lower risk investments like mutual funds and are more likely to withdraw during market fluctuations. They have a balanced portfolio seeking moderate risk and return. The analysis is based on a survey of 100 investors using the portfolio management services of HSBC InvestDirect.